Asian Indices:

- Australia’s ASX 200 index fell by -47 points (-0.67%) and currently trades at 6,968.60

- Japan’s Nikkei 225 index has risen by 520.94 points (1.93%) and currently trades at 27,466.61

- Hong Kong’s Hang Seng index has risen by 251.15 points (1.28%) and currently trades at 19,842.58

- China’s A50 Index has risen by 53.7 points (0.41%) and currently trades at 13,130.10

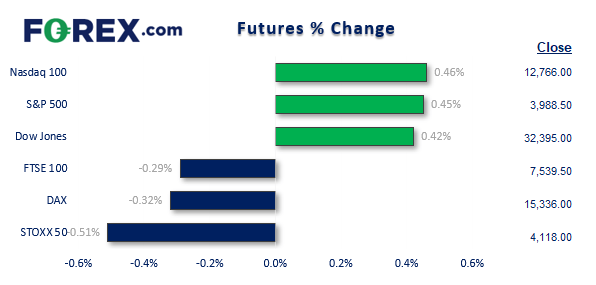

UK and Europe:

- UK’s FTSE 100 futures are currently down -23 points (-0.3%), the cash market is currently estimated to open at 7,543.84

- Euro STOXX 50 futures are currently down -21 points (-0.51%), the cash market is currently estimated to open at 4,174.70

- Germany’s DAX futures are currently down -50 points (-0.32%), the cash market is currently estimated to open at 15,166.19

US Futures:

- DJI futures are currently up 136 points (0.42%)

- S&P 500 futures are currently up 18 points (0.45%)

- Nasdaq 100 futures are currently up 58.25 points (0.46%)

- The US dollar remained the weakest major overnight, following the Fed’s dovish 25bp hike

- Fed fund futures imply a 64.8% chance of a pause at their May meeting, for 5% to be the terminal rate and are close to pricing in a 25bp cut in July

- Whilst the Fed slightly upgraded inflation forecasts for 2023 and 2024, and several members still see rates going higher according to the dot plot, Janet Yellen’s comments on not providing ‘blanket insurance’ for US deposits has also knocked sentiment

- Wall Street was dragged lower yesterday by banking stocks thanks to the combination of Yellen’s comments and Powell’s denial that the Fed intend to cut rates this year

- Asian equities were mixed with the ASX leading Japan’s share markets lower, yet China’s market posted gains thanks to a weaker US dollar

- NZD and AUD are the strongest majors, USD and CHF were the weakest

- European futures point to a weak open as they try to close the gap with US equity markets

FTSE 100 daily chart:

The FTSE has rallied for three days, yet it has stalled at a resistance cluster which includes the August and December highs and the monthly S2 pivot point. Bears could either use a break beneath yesterday’s low or the 7500 handle to assume bearish continuation, with the 7400 / S3 zone making a viable initial target for bears to consider.

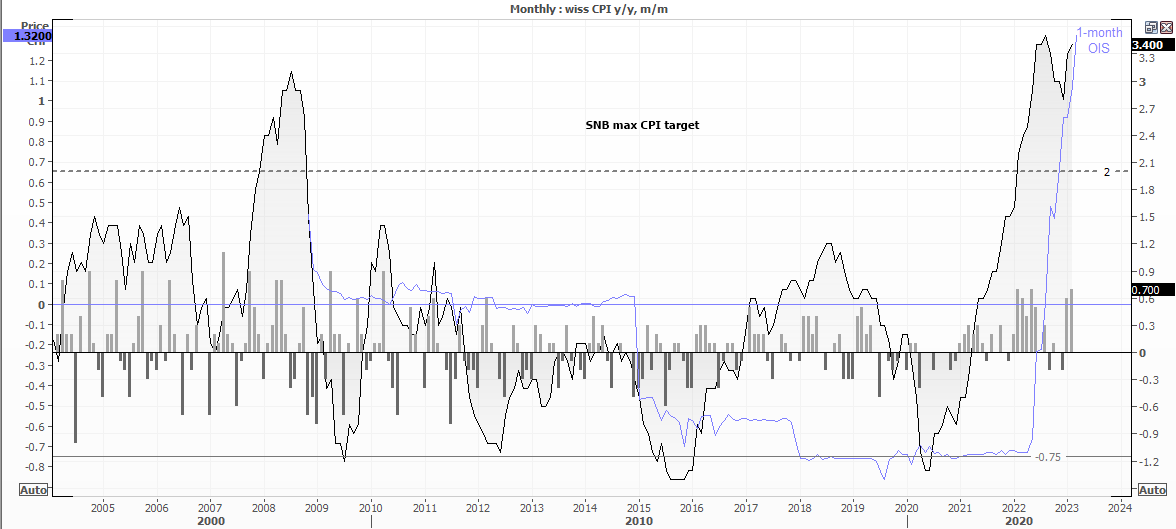

The SNB could hike rates by 50bp at 08:30 GMT:

Until recently, the consensus was for the SNB to hold rates at a relatively low level of 1%. Their rates were at -0.75% until their first 50bp hike in June, which was followed by a 75bp hike in September and then another 50bp in December. So even if they hike by 50bp today, the 1.5% level remains very low by global standards unless we compare it to the BOJ.

So it may be the press conference 09:00 which requires the greater attention to see if there are more hikes to come. And given that inflation was 0.7% m/m higher, the ECB and Fed have hiked and comments from President Jordan have been hawkish overall, I suspect it will be a 50bp hike despite the SNB having to get involved with the Credit Suisse saga.

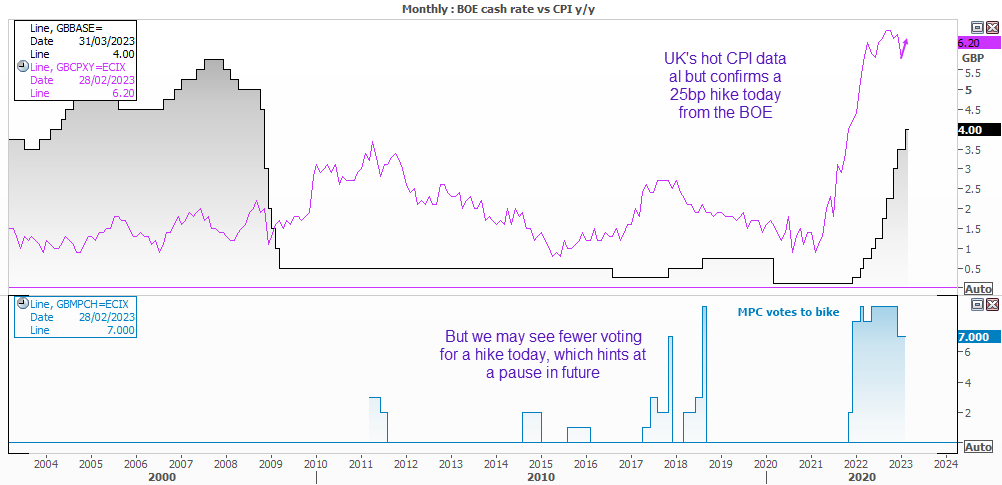

BOE interest rate decision is at 2:00 GMT

Governor Bailey warned that incoming data ahead of today’s meeting could decide whether the BOE hikes or pauses, and with GDP, wages and inflation all pointing higher it is hard to see why they will not hike by 25bp today. And the case becomes stronger now the Fed have hiked by 25bp and the ECB by 50 despite recent turbulence.

So we really want to find out whether there is any discussion of a pause and / or we see less of an appetite for hikes at this meeting via the MPC votes.

Economic events up next (Times in GMT)

— Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge