US Dollar surges post-CPI, breaking ¥149.80 resistance. Focus on Fed’s rate policy amidst liquidity-driven market. Short-term dips seen as buy opportunities, with ¥152 as next key target. Market momentum favors USD as traders navigate global concerns.

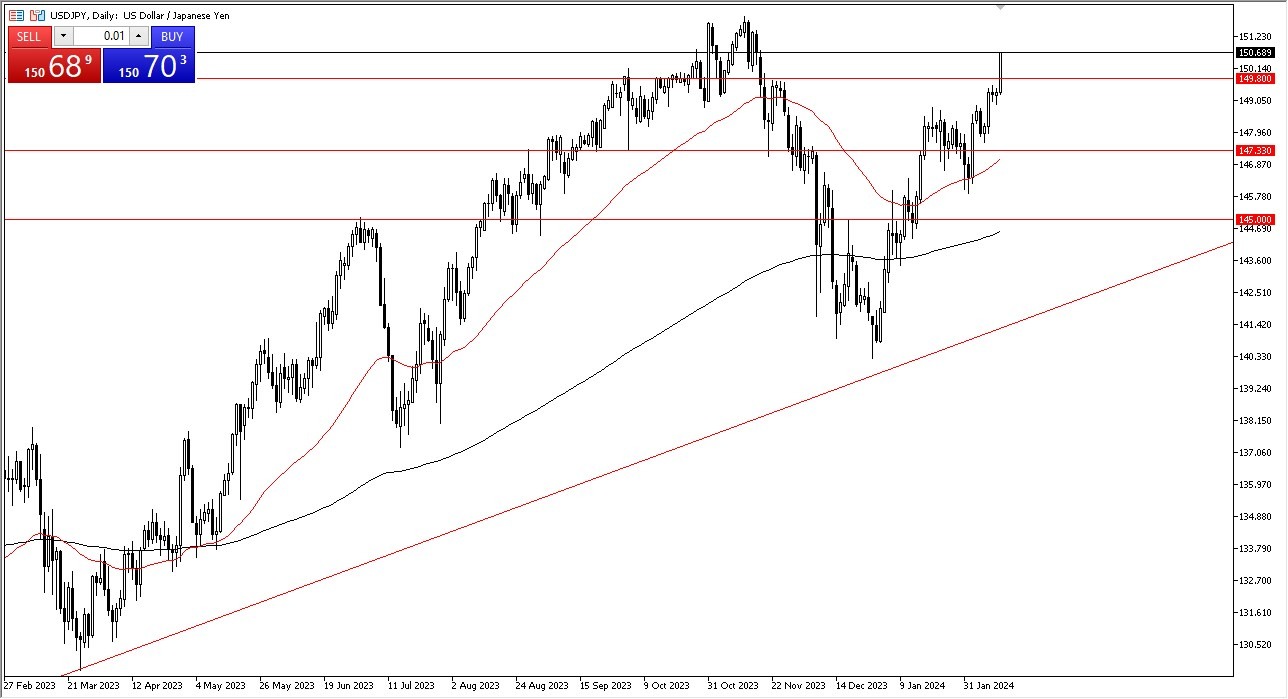

- The US dollar rallied significantly during the course of the trading session on Tuesday, as we broke above the ¥149.80 level, which of course is an area that previously had been a major resistance barrier.

- Now that the Consumer Price Index came out hotter than anticipated, people are starting to focus on the idea that perhaps the Federal Reserve will not be willing to cut rates anytime soon.

All of this comes back to the Great Financial Crisis, as traders have been trained to simply pay attention to what the Federal Reserve is doing instead of anything to do with economic reality. This is all about liquidity, and the reality is that the Federal Reserve may or may not cut any time soon. However, the Bank of Japan is nowhere near being able to tighten monetary policy as Japan has an unsustainable amount of debt. Remember, you do get paid at the end of the day to hold onto this currency pair, and I think that will continue to be a major factor going forward.

Forex Brokers We Recommend in Your Region

Short-term pullbacks are buying opportunities, and I do believe that the ¥149.80 level will be supported. Underneath there, we then have the ¥148 level, followed by the 147.33 and level where the 50-Day EMA is starting to come back into the picture. The 50-Day EMA is an indicator that a lot of people pay close attention to, because it is historically known for support in a dynamic fashion.

On the upside, the ¥152 level is an area that has caused a significant amount of resistance, and if we can break above there is likely that the US dollar will become more or less a “buy-and-hold” type of currency against the Japanese yen, perhaps even against other currencies as well. In general, I think this is a market that you continue to buy on the dip, and I have no interest whatsoever in trying to short this market, because the overall momentum continues to pick up, and quite frankly I just don’t see how the fundamental situation changes anytime soon. Regardless, the US dollar will continue to see a lot of inflows as traders worry about numerous things around the world at the same time.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.