- United States macroeconomic data supports the Federal Reserve’s wait-and-see stance.

- European Central Bank officials gave mixed signals, but rate cuts remain out of the table.

- EUR/USD remains under selling pressure and could fall towards the 1.0550 price zone.

The EUR/USD pair remained under selling pressure throughout the week, extending its slide to a fresh 2024 low of 1.0722 on Monday. The US Dollar momentum, however, receded as days went by, resulting in EUR/USD ending the week pretty much where it started it, around 1.0780.

USD rally stalls, Euro remains unattractive

Major pairs traded within limited ranges amid a scarce macroeconomic calendar and as global policymakers stuck to their cautious stance on future interest rate cuts. Following a row of central banks’ announcements and key economic data, market participants feel discouraged.

Investors hoped central banks would speed up monetary tightening in 2024, given that inflationary pressures continued to ease, and as the risks of steeper economic setbacks pend like Damocles’ sword among most countries. Yet officials made it clear that they are in no rush to change course, comfortable in the current wait-and-see stances. Eventually, interest rates will be lowered, but not before policymakers have more evidence that inflation, employment, and growth are balanced.

Resilient US labor data takes its toll

The absence of fresh clues was behind these days’ choppy trading. But is it so? In fact, what happened is that hints were against speculative interest desire. The United States (US) reported that Initial Jobless Claims moved lower in the week ended February 2 to 218K from 220K expected, as employers retained workers. Furthermore, the ISM Services PMI jumped to 53.4 in January, much better than the 52.0 expected. Also, the ISM Services Prices Paid sub-index soared to 64.0 from 56.7 in January. Finally, the December Goods and Services Trade Balance posted a deficit of $62.2 billion, as expected. These figures indicate that the labor market remains tight, inflation risks are still high, and the economy continues to grow at an uneven pace. In two words, data supports the Federal Reserve’s (Fed) decision to wait before trimming rates, as the monetary policy may not be restrictive enough. And that’s not what the market wants to hear.

Market players got some good news ahead of the weekly close, as the US Bureau of Labor Statistics (BLS) revised the monthly Consumer Price Index (CPI) increase for December lower to 0.2% from 0.3%, while November’s CPI increase was revised higher to 0.2% from 0.1%.

Eurozone weakness

The situation is even more fragile in Europe. Macro data keeps suggesting the economic downturn is yet to find a bottom. The Hamburg Commercial Bank (HCOB) released the final updates of the January Services and Composite PMIs, which confirmed the Eurozone economic activity remained in contraction territory at the beginning of 2024. News coming from Germany were mixed, as Factory Orders rose 8.9% in December, beating expectations, although Industrial Production in the same month declined 1.6%.

Meanwhile, the European Central Bank (ECB) published the Economic Bulletin, which showed the Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner, adding the risks to economic growth remain tilted to the downside. Furthermore, the document acknowledged the Euro Area economy is likely to have stagnated at the end of 2023. Finally, it reiterated that the Governing Council would maintain rates at sufficiently restrictive levels for as long as necessary. True, some officials seem to be more willing to trim interest rates, but it won’t happen in the first half of the year.

US inflation under the spotlight

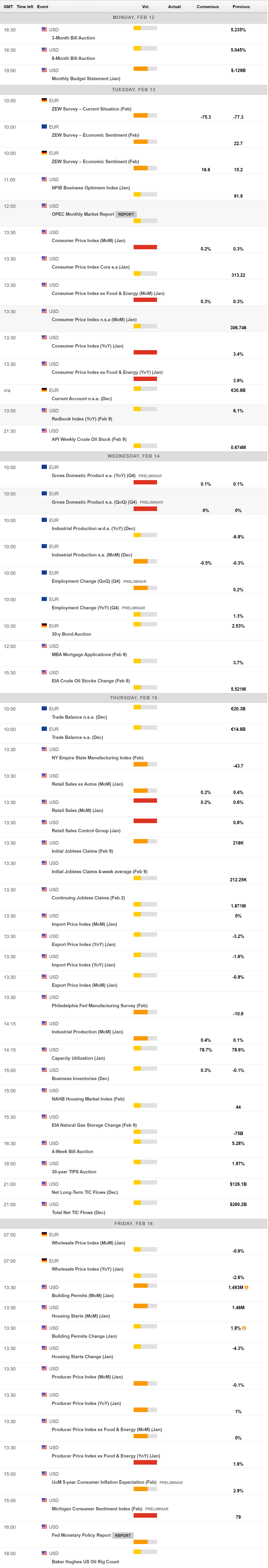

The US will release the January CPI next Tuesday, foreseen at 0.2% MoM and 3.0% YoY. The country will later unveil the Producer Price Index (PPI) for the same period, as well as Retail Sales. Softer-than-anticipated inflation readings could revive speculation of a March rate cut despite local policymakers clearly positioning against such a movement.

The Eurozone will publish a revision of the Q4 Gross Domestic Product (GDP) mid-week, with no other relevant figures scheduled for the days to come.

Finally, on Friday, the focus will be on the Fed Monetary Policy Report, while the US will publish the preliminary estimate of the February Michigan Consumer Sentiment Index.

EUR/USD technical outlook

From a technical point of view, the risk remains skewed to the downside. The weekly chart shows that EUR/USD is battling to retain ground above a directionless 20 Simple Moving Average (SMA) while developing further below an also flat 200 SMA. Technical indicators, in the meantime, gain downward traction, although they remain within neutral levels.

In the daily chart, the EUR/USD pair is developing below all its moving averages, meeting sellers around a mildly bullish 100 SMA. The 20 SMA, in the meantime, keeps heading firmly lower, far above the current level, reflecting sellers’ strength. Finally, technical indicators remain within negative territory with modest upward slopes, not enough to confirm a steeper advance.

The monthly low at 1.0722 is the immediate support level en route to the 1.0640 region. A break below the latter could result in a slide towards the 1.0550/60 price zone. On the other side, EUR/USD would need to recover beyond the 1.0840/50 area to be able to extend gains towards the 1.0930 price zone.