The EUR/USD traded on the same performance as last week’s, stabile above the 1.1800 resistance in an attempt to complete the upward correction path, which failed to surpass the 1.1880 resistance, and the pair stabilized around 1.1825 at the time of writing.

Expectations still indicate that the single European currency is vulnerable to losses in the coming days if the European Central Bank’s concerns about the currency’s strength are expressed at the monetary policy meeting next Thursday, amid growing concerns about the Eurozone economy in view of the continuing rise in Coronavirus cases in Europe.

Pressures of yesterday’s trading were supported by a weak start for the stock markets, amid investor caution before the US elections, the failure of American politicians to agree on a new stimulus package and the continuing concerns about Coronavirus cases. “The resurgence of COVID-19 cases is starting to weigh on European currencies,” says Nikolaus Sgoropoulos, an analyst at Barclays Bank. “The recent wave of increased new cases in Europe has led to the imposition of domestic restrictions that may affect the emerging economic recovery.” He added.

We expect the wider global background to maintain its grip on the forex currency markets, with the general rule of trading being the appetite for safe haven, and therefore the dollar will rise when the markets decline, while the Euro is expected to outperform when the markets rise. However, as for the single European currency, some domestic risks await us in the coming days as Thursday’s ECB meeting will be the main event on the calendar.

“The Euro faces more challenges this week,” said Peter Karbata, chief strategist for the EMEA region for currencies and bonds at ING. “Our team is expecting a strong pessimistic message from Bank Governor Lagarde and lots of hints about further quantitative easing in December. Incidentally, European Central Bank research recently concluded that an increase in the ECB’s balance sheet size by 10% relative to the Federal Reserve could lead to a 3.5% drop in the EUR/USD rate.”

On the other hand, investors seem to rule out any possibility that the current president will win the presidential elections on Tuesday, November 3, after last week’s discussion, which could lead to gains for most currencies against the dollar. However, investors may struggle this week to avoid noticing a renewed negative European economic divergence. Although the resurgence of the COVID-19 cases and the negative impact on the economy are sparking calls for more political support. However, we are not expecting new policy announcements from the European Central Bank this week, but they could send pessimistic signals to the December decision to increase/extend PEPP.

On the economic side, the PMI measures for the US services and manufacturing sectors rose for October on Friday, in contrast to poll results in Europe as manufacturing-related gains were marred by coronavirus-related declines in measures of activity within the bloc’s services sector.

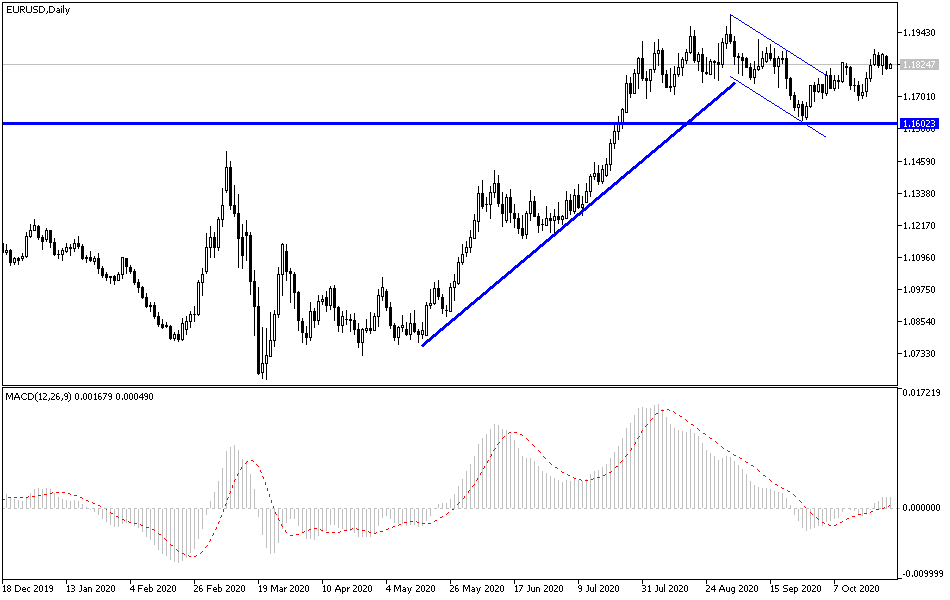

As for the EURUSD outlook: Karen Jones, Head of Technical Analysis for Currencies, Commodities and Bonds at Commerzbank says, “Elliott waves statistics indicate that declines should stabilize around 1.1770 and above 1.1871 (Sept 21 high), and recovery will begin to 1.1971, starting at $1.1810, and a close below 1.1688 means losses to a recent low at 1.1612.”

According to the technical analysis of the pair: I still see that the EUR/USD stability above the 1.1800 resistance raises the bulls’ desire to control the performance, but what stops gains would be the European Central Bank’s comments, especially when then pair tested the 1.2000 psychological resistance. On the downside, the pair’s return towards the 1.1745 support will strengthen the bearish outlook again. I still prefer to sell the pair from every upper level.

As for the economic calendar data today: Regarding the Euro, the Eurozone’s money supply and private loans will be announced. Regarding the dollar, US durable goods orders, consumer confidence and the Richmond Industrial Index reading will be released.