Deere & Company DE is scheduled to report fourth-quarter fiscal 2023 results on Nov 22, before the opening bell.

Which Way Are Estimates Trending?

The Zacks Consensus Estimate for Deere’s earnings per share is pegged at $7.49 for the fiscal fourth quarter, suggesting growth of 0.67% from the year-ago reported figure. The Zacks Consensus Estimate for total revenues is pinned at $13.8 billion, indicating a year-over-year decrease of 3.9%.

Deere & Company Price and EPS Surprise

Deere & Company price-eps-surprise | Deere & Company Quote

Q3 Results

Deere’s sales and earnings surpassed the Zacks Consensus Estimate in the third quarter of fiscal 2023. The bottom and top lines increased year over year. On average, the company has a trailing four-quarter earnings surprise of 15.4%.

What Does Our Model Indicate?

Our proven model predicts an earnings beat for Deere for fourth-quarter fiscal 2023. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

Earnings ESP: The Earnings ESP for Deere is +0.25%. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: Deere currently carries a Zacks Rank #3.

Key Factors to Consider

Although agricultural commodity prices have been volatile through the August-October quarter, they were above historical averages. This is expected to have prompted farmers to boost spending on new agricultural equipment and replace the old ones. The preference for Deere’s products for their advanced technologies and features is likely to be reflected in its fiscal fourth- quarter revenues.

However, high production costs; selling, administrative and general expenses; research and development expenses; and the unfavorable effects of foreign currency exchange are likely to have impacted the company’s margin in the quarter. We expect research and development expenses to be up 9.3% year over year and selling, administrative and general expenses to increase 5.5% year over year in the quarter.

Nevertheless, favorable price realization and higher shipment volumes/sales mix are expected to have negated some of these headwinds, as seen in the fiscal first quarter. Also, recently, industry players have noted that supply-chain issues have shown signs of easing, which is likely to have aided Deere’s performance fourth-quarter performance.

Segment Projections

Our model predicts the Production & Precision Agriculture segment’s revenues to be $6,567 million for the fiscal fourth quarter, suggesting a year-over-year decrease of 11.7%. We expect the segment’s operating profit to be $1,677 million, indicating a 3.6% fall from the prior-year quarter’s reported figure. Gains from higher shipment volumes and price realization are likely to have been somewhat offset by escalated production costs and higher R&D and SA&G expenses.

Our estimate for the Small Agriculture & Turf segment’s revenues is pegged at $3,175 million for the fiscal fourth quarter, indicating a 10.4% decline from the prior-year quarter. The segment’s operating profit is estimated at $483 million, suggesting a 4.6% year-over-year fall. The small Agriculture & Turf segment’s performance is expected to have been affected by elevated production costs, higher R&D and SA&G expenses and the unfavorable effects of foreign exchange, partially offset by price realization and improved shipment volumes.

The Construction & Forestry segment’s sales are estimated at $3,772 million for the fiscal fourth quarter, up 11.8% from the prior-year quarter’s reported number on solid demand. We predict the segment’s operating profit to rise 63.5% from the prior-year quarter’s reported figure to $677 million.

Our estimate for the Financial Services segment’s revenues is pegged at $1,049 million for the fiscal fourth quarter, up 6.1% from the year-ago quarter. Our projection for the segment’s operating profit is pinned at $276 million, whereas it reported $297 million in the prior-year quarter.

Price Performance

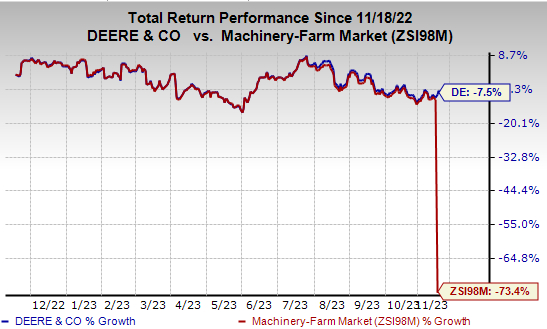

Deere’s shares have lost 7.5% in the past year compared with the industry’s fall of 73.4%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Here are some other stocks that you might consider, as our model shows that these, too, have the right combination of elements to beat on earnings in the upcoming releases.

American Eagle Outfitters, Inc. AEO, scheduled to release earnings on Nov 21, has an Earnings ESP of +4.51. It has a trailing four-quarter surprise of 43.2%, on average.

The Zacks Consensus Estimate for American Eagle Outfitters’ earnings for the third quarter is currently pegged at 48 cents. AEO currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco Wholesale Corporation COST, scheduled to release earnings on Dec 14, has an Earnings ESP of +4.26.

The Zacks Consensus Estimate for Costco Wholesale’s earnings for the fiscal first quarter of 2024 is currently pegged at $3.43. COST currently carries a Zacks Rank #2. It has a trailing four-quarter surprise of 2.1%, on average.

American Public Education, Inc. APEI, expected to release earnings soon, has an Earnings ESP of +92.99.

The Zacks Consensus Estimate for American Public Education’s earnings for the fiscal first quarter of 2024 is currently pegged at 8 cents. APEI currently carries a Zacks Rank #2. It has a trailing four-quarter surprise of 23.2%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

American Public Education, Inc. (APEI) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.