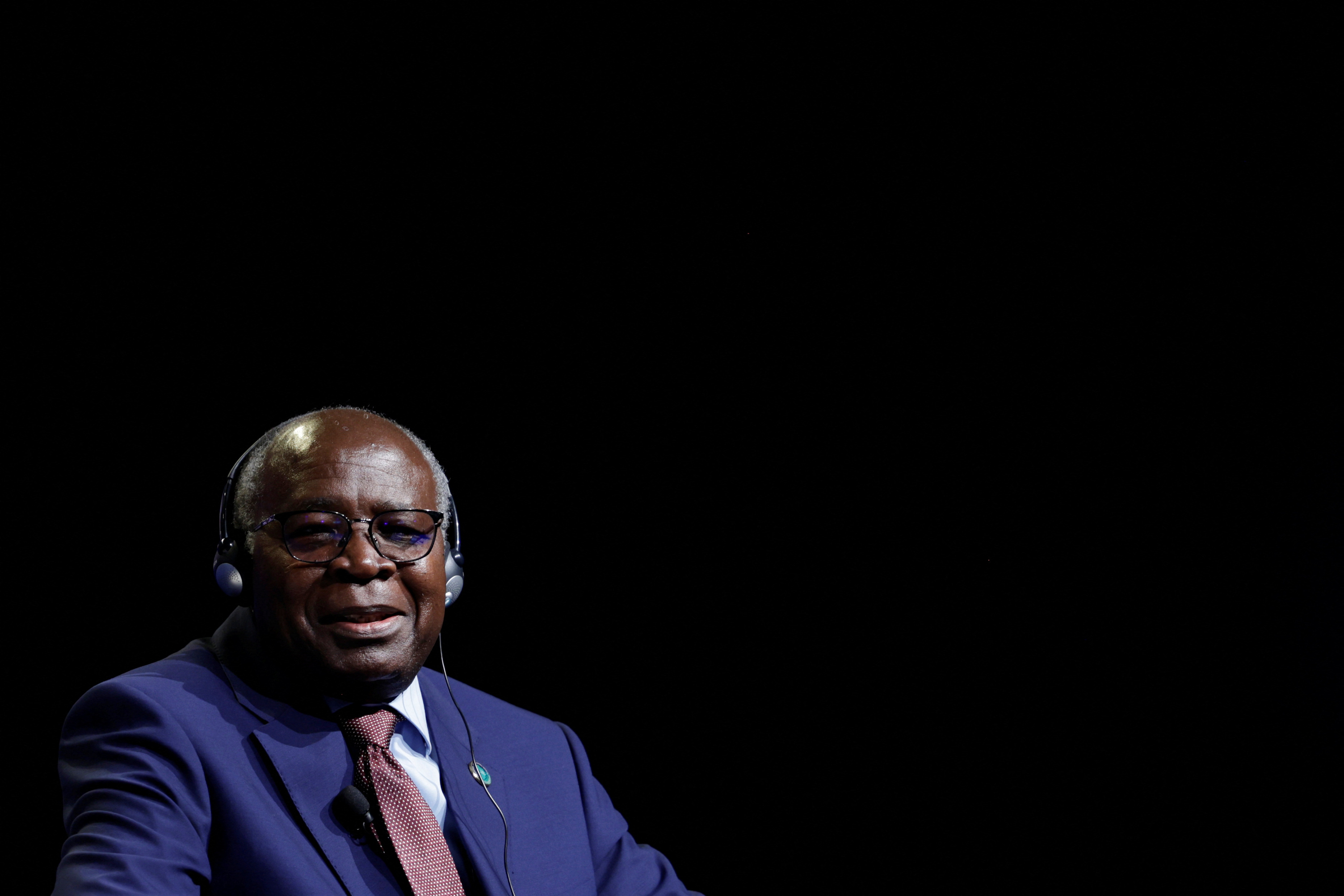

Zambia’s Finance Minister Situmbeko Musokotwane attends a panel on the fourth day of the annual meeting of the IMF and the World Bank, following last month’s deadly earthquake, in Marrakech, Morocco, October 12, 2023. REUTERS/Susana Vera Acquire Licensing Rights

MARRAKECH, Morocco, Oct 14 (Reuters) – Zambia has agreed a memorandum of understanding (MoU) with its bilateral creditors on restructuring about $6.3 billion of debt, almost three years after the southern African country defaulted, the finance ministry said on Saturday.

Zambia was the first African country to default on its debt in the pandemic era and its restructuring process saw it agree broad terms to rework the debt with official creditors including China and members of the Paris Club of creditor nations in June.

“Each official creditor will now begin their internal process to sign the MoU. Following the signing of the MoU, the terms will be implemented through bilateral agreements with each member of the OCC (Official Creditor Committee),” a ministry statement said.

The agreements will include an average extension of debt maturities of more than 12 years, with interest rates set at 1% during the next 14 years and up to 2.5% after that. There is a mechanism to increase payments if Zambia’s economy performs better than expected.

Zambia will pay about $750 million in the next decade compared to almost $6 billion that was due to official creditors before the debt restructuring.

“The next step is to secure a comparable agreement with our private creditors,” Zambia’s finance minister, Situmbeko Musokotwane, said.

Zambia is committed to remaining in arrears to its commercial external creditors, the ministry said, until it secures a debt deal with comparable terms to the official creditor agreement.

The copper producer’s commercial creditors include international bondholders, who are owed more than $3 billion.

The country is currently in formal talks with a bondholder creditor committee to restructure more than $3 billion of overseas bonds.

The discussions kicked off earlier in October, so for now the creditors are restricted from trading the country’s notes. Zambia has three outstanding dollar bonds maturing in 2022 , 2024 and 2027 , currently trading at 52-58 cents on the dollar.

It is unclear how long the signing of the agreements between Zambia and each bilateral creditor is going to take.

“We are grateful to all our official creditors, especially the co-chairs of the committee, China and France, and vice-chair South Africa, for their commitment to help resolve Zambia’s debt overhang,” Musokotwane said.

On Thursday, International Monetary Fund (IMF) Managing Director Kristalina Georgieva said Zambia had signed the MoU with official creditors, which was later walked back by Zambia’s finance minister and the IMF.

Reporting by Rachel Savage and Jorgelina do Rosario; editing by Giles Elgood

Our Standards: The Thomson Reuters Trust Principles.