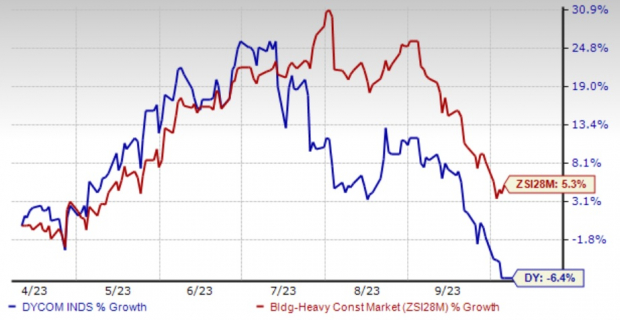

Dycom Industries, Inc. DY dipped 6.4% in the past six months against the Zacks Building Products – Heavy Construction industry’s 5.3% growth. This Florida-based specialty contracting service provider has been witnessing higher fuel costs, labor woes and supply constraints.

Despite continuous contract flow and backlog, seasonal impacts on fiscal first and fourth quarters are concerning the company.

The Zacks Consensus Estimate for fiscal 2024 earnings moved down to $6.46 per share from $6.48 in the past seven days.

DY has been riding on a solid backlog level and funding from Federal stimulus bills passed over the past few years. It is also benefiting from higher demand for a single high-capacity fiber network, an extended geographic reach and network planning services. However, prevailing macroeconomic headwinds are pressing concerns for this Zacks Rank #3 (Hold) company.

Let’s discuss the hurting factors in detail.

Image Source: Zacks Investment Research

Macro-Economic Headwinds: Dycom’s business has been impacted by persistent macroeconomic issues like supply chain disruption, energy market volatility and labor woes. Broad increases in demand for fiber optic cable and related equipment may cause delivery volatility in the short to intermediate term. The automotive and equipment supply chain remains challenging, particularly for the large truck chassis required for specialty equipment. The prices of capital equipment are increasing.

During fiscal 2023, equipment maintenance and fuel costs increased by 0.3% as a percentage of contract revenues, primarily due to an increase in fuel prices. The company expects these factors to likely impact demand in the future.

Seasonality & Cyclicality: Dycom’s first and fourth quarters of every fiscal year are prone to seasonality. Each year, its first and fourth quarter results are impacted by inclement weather, fewer available workdays, reduced daylight work hours and the restart of calendar payroll taxes. Considering these headwinds, the company has projected contract revenue growth in the mid- to high-single digits and a modest improvement in adjusted EBITDA margin.

Dycom’s services are highly cyclical and remain vulnerable to economic downturns. During times of economic downturn, volatility in the credit and equity markets reduces the availability of debt or equity financing, which, in turn, reduces capital spending on the part of clients. Other macroeconomic factors, like currency exchange rates, can impact business, as the company has a considerable business presence in Canada.

Energy Market Woes: Fluctuations in the price of oil can pose significant headwinds for the company, as the cost of conducting business is linked with an increase in fuel prices. As the majority of contracts do not allow the company to adjust pricing for higher fuel costs during a contract term, Dycom’s inability to accommodate price increases adds to its woes and directly hurts margins.

Concentrated Sales: A significant portion of Dycom’s sales come from its top five customers. During the first half of fiscal 2024, Dycom’s largest customer, AT&T, contributed 19.1% to total revenues. Lumen (the second-largest customer) added 14.3% to total revenues and Comcast made up 11.5% of the same. Verizon and Frontier represented 9.8% and 6.8% of revenues, respectively. On a combined basis, the company’s top-five customers generated approximately 66.7%, 66.2% and 74.1% of revenues during fiscal 2023, fiscal 2022 and fiscal 2021, respectively. In the first half of fiscal 2024, the combined contribution of the top five customers was approximately 38.5%.

Key Picks

Some better-ranked stocks from the Construction sector are TopBuild Corp. BLD, Sterling Infrastructure, Inc. STRL and Fluor Corporation FLR.

TopBuild currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BLD delivered a trailing four-quarter earnings surprise of 14.1%, on average. Shares of the company have risen 40.5% in the past year. The Zacks Consensus Estimate for BLD’s 2023 sales and earnings per share (EPS) indicates growth of 3.3% and 8.4%, respectively, from the previous year’s reported levels.

Sterling currently sports a Zacks Rank of 1. STRL delivered a trailing four-quarter earnings surprise of 14.9%, on average. Shares of the company have surged 236% in the past year.

The Zacks Consensus Estimate for STRL’s 2023 sales and EPS indicates growth of 3.9% and 29.4%, respectively, from the previous year’s reported levels.

Fluor currently sports a Zacks Rank of 1. FLR delivered a trailing four-quarter negative earnings surprise of 5.3%, on average. Shares of the company have gained 29.7% in the past year.

The Zacks Consensus Estimate for FLR’s 2023 sales and EPS indicates growth of 12.6% and 159.8%, respectively, from the previous year’s reported levels.

4 Oil Stocks with Massive Upsides

Global demand for oil is through the roof… and oil producers are struggling to keep up. So even though oil prices are well off their recent highs, you can expect big profits from the companies that supply the world with “black gold.”

Zacks Investment Research has just released an urgent special report to help you bank on this trend.

In Oil Market on Fire, you’ll discover 4 unexpected oil and gas stocks positioned for big gains in the coming weeks and months. You don’t want to miss these recommendations.

Download your free report now to see them.

Fluor Corporation (FLR) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.