US dollar Vs Euro, British Pound, Japanese Yen – Price Setups:

- The US dollar could remain in a range in a data heavy week ahead of Easter holidays.

- Limited cues for now from relative monetary outlooks and economic momentum.

- What are the levels to watch in EUR/USD, GBP/USD, and USD/JPY?

Recommended by Manish Jaradi

Traits of Successful Traders

Key US dollar currency pairs could settle in a range ahead of the Easter holidays, with a key focus on global manufacturing activity data (including US ISM due today) and US payroll data due Friday.

Data released Friday showed US inflation eased a bit in February, but perhaps not enough to warrant an imminent US Fed rate pause. Elsewhere, Euro area headline inflation dropped by most on record in March, but core price pressures accelerated, keeping alive hopes of further European Central Bank tightening. The Bank of England has left the door open for further hikes, while the Bank of Japan’s next meeting at the end of April will be closely watched as the new central bank governor takes charge.

Moreover, US macro data have been stronger than expected since February (Economic Surprise Index is at a one-year high). UK macro data have surprised to the upside in recent weeks, but Euro area and Japan economic data have been less upbeat since February and March respectively.

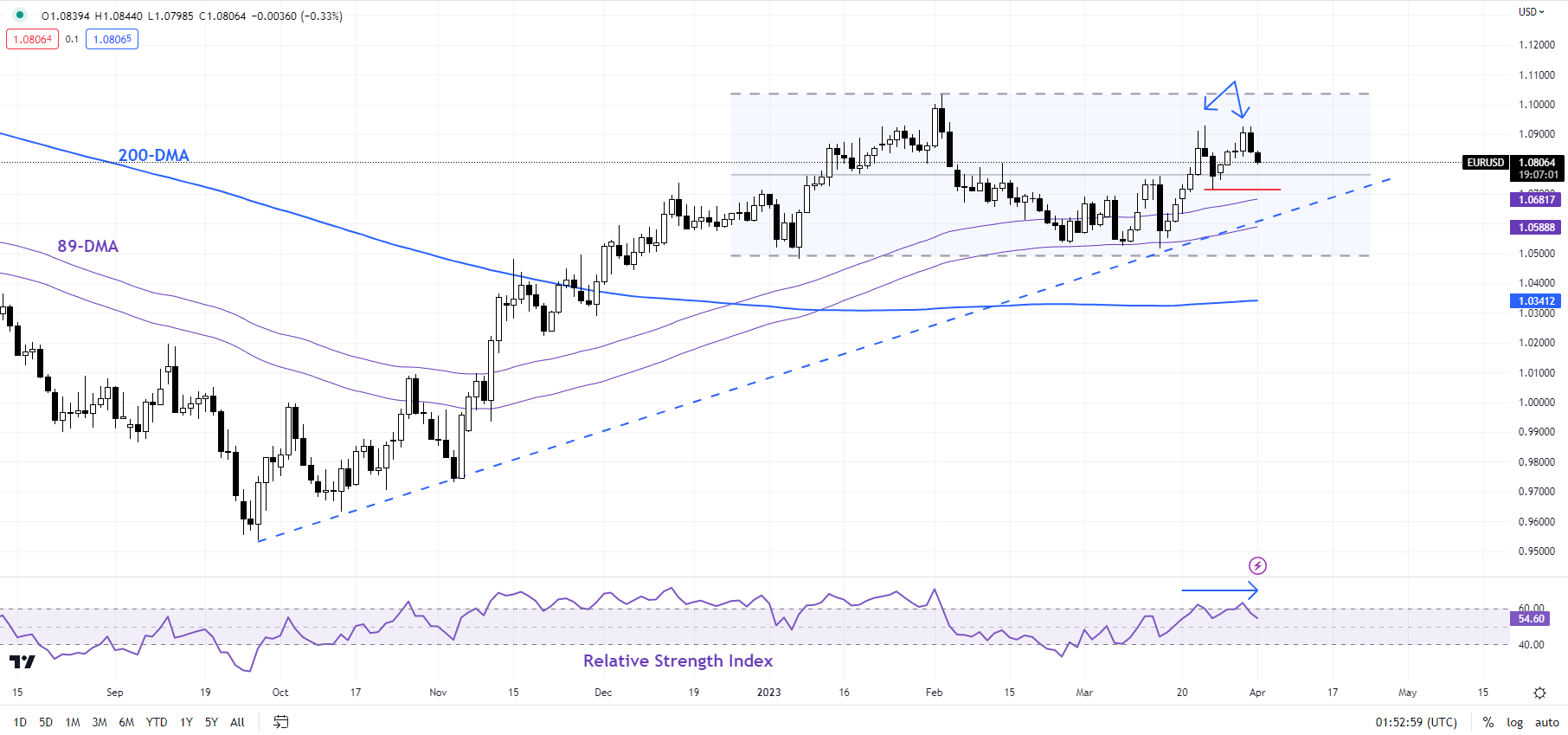

EUR/USD Daily Chart

Chart Created Using TradingView

EUR/USD – Upside capped for now

EUR/USD appears to be struggling to extend gains – momentum on the daily charts has stalled in recent sessions as the pair approaches stiff resistance at the February high of 1.1035. Immediate support is at the March 24 low of 1.0710. Any break below would trigger a minor double top (the late-March highs), exposing downside risks toward the March low of 1.0515. Beyond the very near term, EUR/USD looks set to remain within its recently well-established range of 1.05-1.10.As highlighted in the previous update, the rebound last month from around a key floor at the January low of 1.0480 keeps the higher-top-higher-bottom sequence (uptrend) from late 2022 intact.

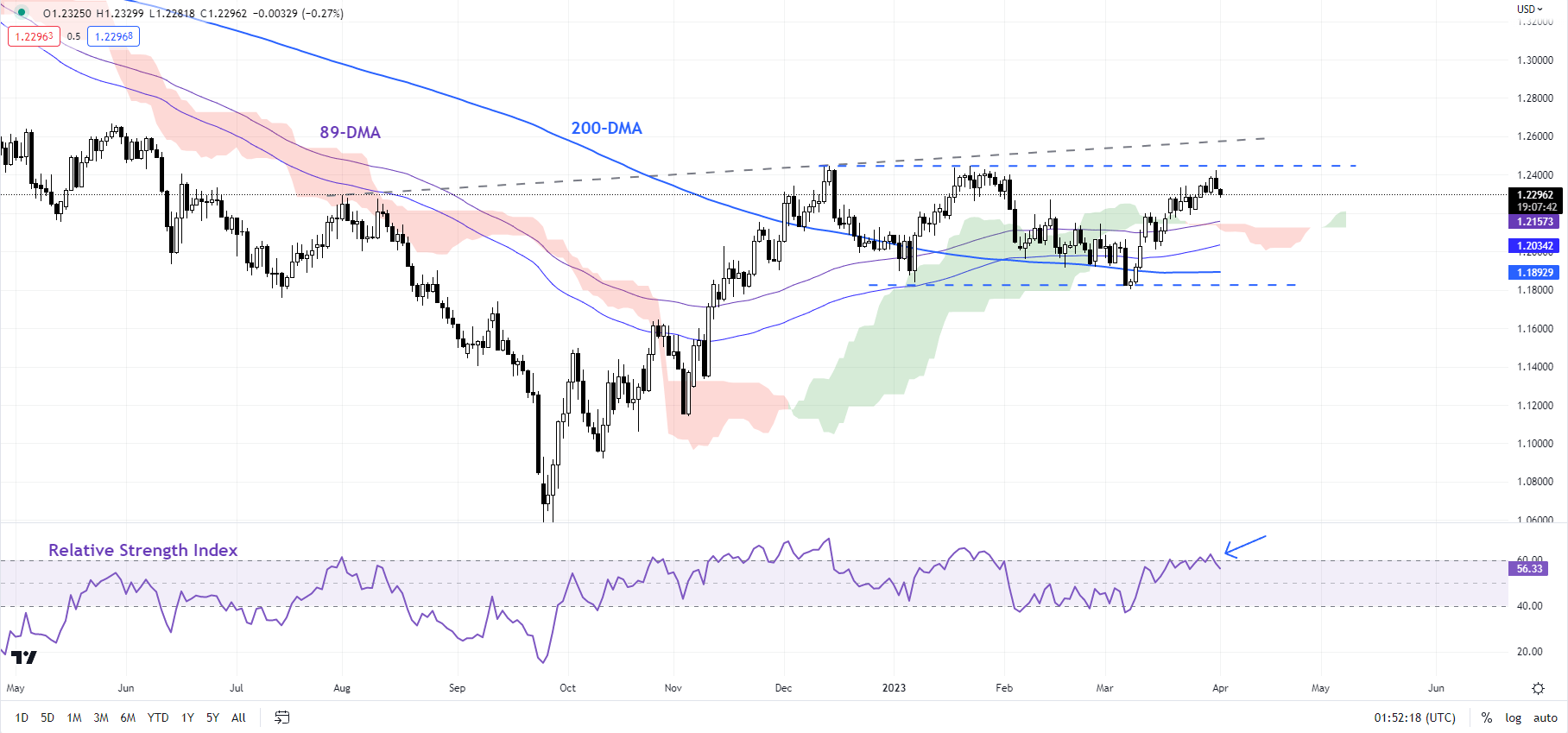

GBP/USD Daily Chart

Chart Created Using TradingView

GBP/USD – Tough hurdle at 1.2450

GBP/USD’s failure last month to break below a crucial support at the January low of 1.1840 indicates that the uptrend from late 2022 remains in place. For more discussion on this see “British Pound Price Setup: GBP/USD, EUR/GBP, GBP/JPY”,published March 29. Having said that, the rally since early March appears to be losing steam somewhat as the pair has run into a tough hurdle at the December high of 1.2450. Still, any downside could be limited, with quite a strong cushion near the late-March low of 1.2200. As noted in theprevious update, any break above 1.2450 could potentially open the door for meaningful gains in GBP/USD.

.

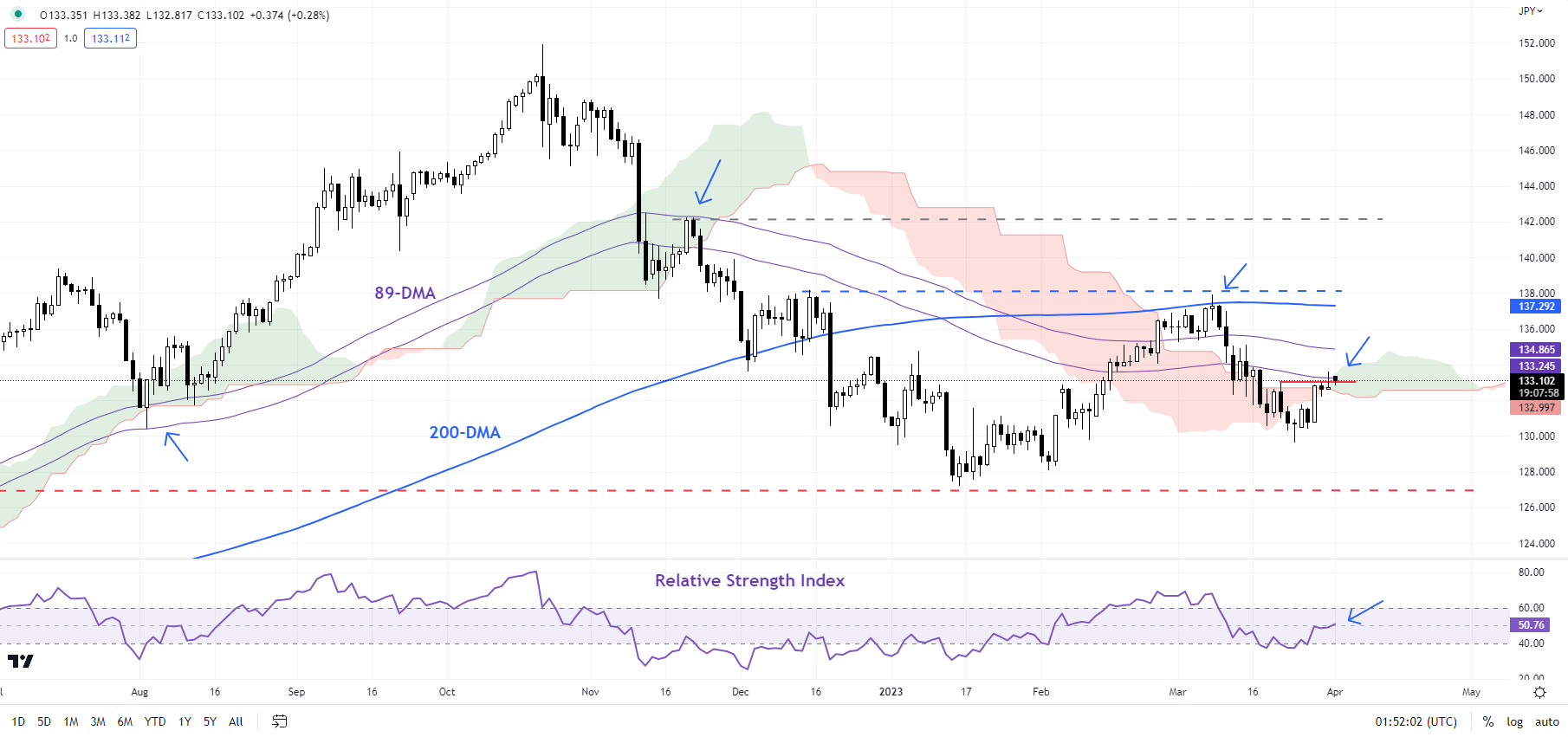

USD/JPY Daily Chart

Chart Created Using TradingView

USD/JPY – Tests a vital barrier

USD/JPY is testing a fairly strong converged ceiling: the 89-day moving average, the Ichimoku cloud cover on the daily charts, and the late-March high of 133.00. For now, the broader bias remains down (See “Japanese Yen Price Setup: USD/JPY, AUD/JPY, EUR/JPY”, published March 27), but any break above the converged barrier could alleviate some of the immediate downside risks, and raise the prospect of a broad range of 127-138 developing in the near term. Furthermore, a break above the converged barrier could open the way toward the 200-day moving average, roughly coinciding with the March high of around 138.00.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish