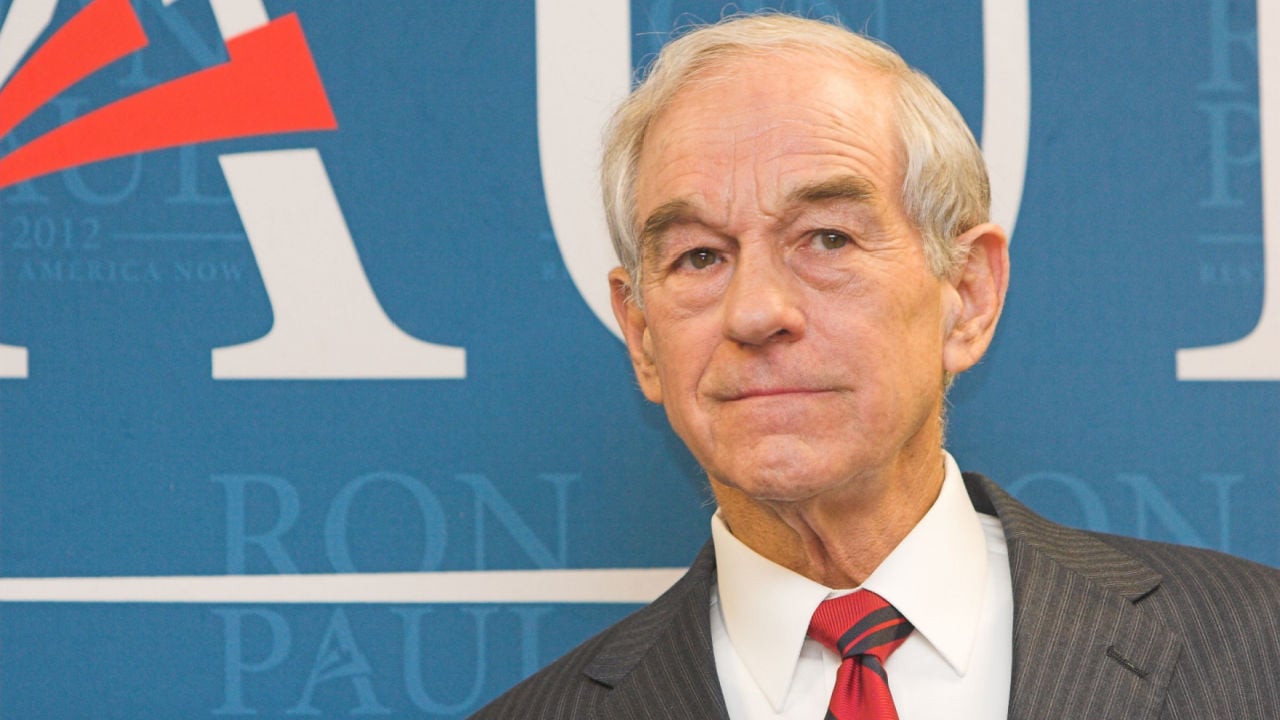

Ron Paul, a former U.S. representative and member of the Libertarian Party, has addressed recent events directed to undermine the influence of the U.S. dollar as a reserve currency in international markets. Paul believes that even if this does happen, it will probably take more time than some predictions are saying.

Ron Paul Analyzes Fall of US Dollar Hegemony

In the latest edition of his online webcast “The Ron Paul Liberty Report,” former United States representative Ron Paul analyzed the standing of the U.S. dollar as a reserve currency and how current events involving China, Russia, Brazil, and other countries are threatening this position.

Paul believes that if the U.S. dollar is eventually dethroned as a reserve currency, this will take more time than some predictions are currently announcing, according to the former congressman. On this, he stated:

People have been talking about this for a long time, and it’s amazing, it’s always longer than some predictions. Somebody could have said in 1930 that the dollar standard is not going to last long with the Fed taking over. Predicting the exact time is very difficult.

Furthermore, he explained the different stages that the U.S. dollar has faced, putting special emphasis on the abandonment of the Bretton Woods system by former president Richard Nixon, reminding viewers that even then, people heralded the end of the dollar as it became an inflationary currency with no backing.

Consequences of Having a World Reserve Currency

Paul explains that while owning a national currency as a world reserve currency had its benefits for the U.S., it also presented shortcomings. Paul declared:

It gives us a license to inflate. It gives us sanctions to interfere in the market with sanctions. License to fight wars we shouldn’t fight.

For Paul, the demise of the dollar started with the creation of the Federal Reserve, which has a license to manipulate the monetary policy of the country without congressional approval. However, Paul believes that there is an acceleration with the recent movements of countries seeking to ditch the dollar as a trade currency.

There are signs that something big is happening, and it has to do with China, Brazil, and Russia. They are ganging up on us. If they are succesful, people will find a scapegoat, but it is not true. We have to look at our monetary policy in a much more honest way.

What do you think About Ron Paul’s stance on the demise of the U.S. dollar? Tell us in the comment section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Rich Koele / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.